New York has been providing tax breaks for young businesses since the dawn of Silicon Alley in the mid 1990s. In 1995 City Hall issued tax credits to the New York Information Technology Center (NYITC) to try to encourage some of the new media companies to move to empty office space in the downtown financial district. We took a look at some of the incentives available to the army of startups inhabiting New York today.

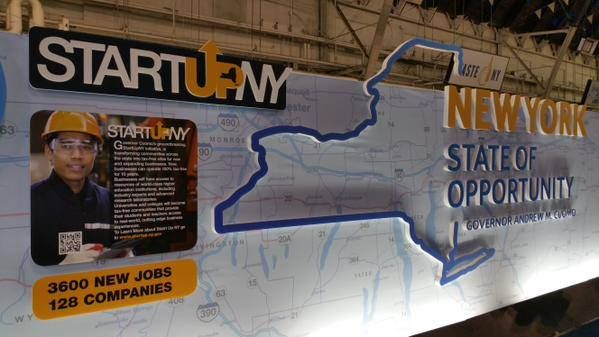

StartUp NY

StartUp NY is a statewide program introduced by Governor Andrew Cuomo in 2014. It allows new and expanding businesses to go completely tax free for 10 years, provided they relocate to specific zones spotted around the state, mostly near University campuses. In NYC that means the NYU incubator spaces on Varick Street and DUMBO, and a number of small spaces from CUNY and SUNY spotted around the outer boroughs. StartUp NY promises a 10-year exemption from property, sales, and state income taxes for businesses located in these zones. There are however a few stipulations. For starters, you have to be willing to partner with the participating universities and certain industries are not eligible including retailers, hotels, medical providers and law offices. Only business operations carried out within the campus will be tax exempt, so Internet companies selling to partners or customers outside the zones could be taxed on those revenues. As for personal income tax, employees working on campus will pay no state or local taxes for the first five years and only pay in the second five year period if you are earning more than $200,000 per annum. However only the first 10,000 people employed under the program will be eligible.

Hardware Sales Tax

Sales tax in the empire state is a hefty 8.875 percent. But if you’re a technology company in New York, you shouldn’t be paying anything at all. A little known provision in New York’s sales tax laws states that computer hardware being used for the design and development of software or websites is exempt. This broad definition could probably include any electronic device apart from mobile phones, being used in the New York tech scene. Exemption 1115 (a)(35) applies to: “Computer system hardware used or consumed directly and predominantly in designing and developing computer software for sale or in providing the service, for sale, of designing and developing internet websites.”

Computer hardware is defined as any of the following devices: Microcomputers, Minicomputers, Mainframes, Personal / Laptop Computers, Tablets, External Hard Drives, Portable Disc Drives, CD Drives, Modems, Monitors, Keyboards, Mice, Printers, Scanners, Servers, Network Interfaces, Network Hubs and Network Routers. Once you’re using it for work at least half the time that counts as “predominantly” and should make the device eligible. One point where startups may not be eligible is if they operate on a free or freemium model. The law states that the software must be for sale.

NYC Tax Incentives

Former NYC mayor Michael Bloomberg introduced a number of aggressive tax incentives in order to foster startup growth and attract big tech companies to the city. This trend continues today and NYC offers a plethora of tax relief programs. The following guide from the New York City Economic Development Corporation (NYCEDC) lists a total of 100 different programs and incentives aimed at reducing taxes for businesses in the city. City government has a special online incentives calculator at https://www.nyc.gov/BusinessExpress which can be used to see which schemes apply to your business.

Some of the most applicable to tech startups include: Qualified Emerging Technology Companies (QETC) Incentive Program which grants up to $300,000 per year for companies to implement new emerging technology, the NYC BioTech Tax Credit and a Lower Manhattan commercial rent tax reduction.

Have a tax incentive you’d like to share? Send us an email to [email protected].