Lemonade founders Shai Wininger and Daniel Schrieber

In the pre-internet days, homeowners and renters obtained insurance by paying a visit to their local insurance agency. They would fill out lengthy paperwork with an insurance agent, waiting for that insurance agent to submit the application to various insurance companies, at which point the agent would generate a premium.

With the rise of the internet, insurance giants like GEICO and Progressive turned to television and the media (enter The Gecko and Flo) in the early- to mid-200s to advertise the new wave of insurance. Homeowners and renters could now go directly to a website to get insurance, cutting out the insurance agent with an instant e-mailed quote.

New York-based peer-to-peer insurance startup Lemonade is now upending the insurance model once again.

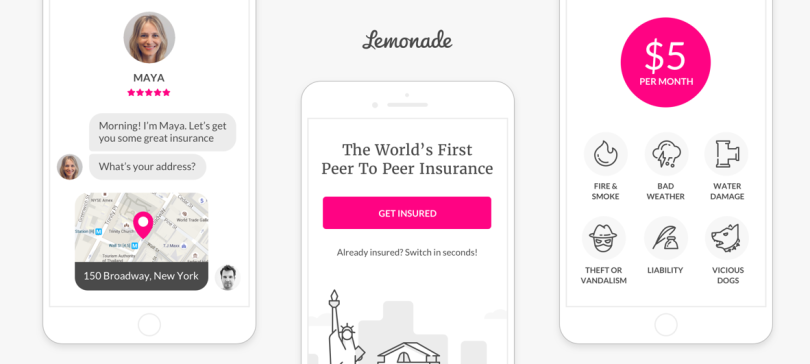

Lemonade was founded in 2015 by Daniel Schrieber and Shai Wininger, who built a platform driven by technology and transparency in order to bring a faster and more affordable insurance model to market. Currently, the company’s policies for renters and homeowners insurance start at $5 and $35 a month, respectively, which is two to four times less than the industry standard.

Traditional insurance companies require people to pay high premiums each year with nothing in return, making money by keeping the money they don’t pay out in claims. In contrast, Lemonade makes money by charging a 20 percent flat fee from monthly policy payments, removing the bureaucracies that typically pervade the insurance industry.

The company also challenges the existing insurance model through its annual ‘giveback’ policy, where the company donates unclaimed money to causes its users care about.

Additionally, Lemonade utilizes a chatbot, Maya, eliminating the hassle, paperwork and time needed to sign up and manage insurance. On Lemonade’s web or mobile platform, the AI service can quickly and easily generate a personalized policy, cancel your old policy for you and allow you to pay natively within the app.

The news follows the company’s official launch out of stealth three months ago when it became a fully licensed insurance provider in New York.

Does your startup have news to share? Let us know or tweet us @builtinnewyork.