I recently bought a 2008 BMW 335xi that is inspiring me to write this post.

I plan to use it as my daily driver and rent it out on Turo for a premium (if rented, I’ll just drive my work truck).

It was a smoking deal, and has some serious appeal being black on black, all-wheel-drive, and 300 hp. Now if you’re not a car person, I’m still writing this for all entrepreneurs out there.

All aspiring entrepreneurs should put a lot of thought into the assets and their net worth when considering launching a business.

Before we get started, I’d like to disclose two things:

-I am still experimenting and always looking to learn more on how to increase my passive income, and acquire more quality assets faster.

-Even though the auto industry is probably the easier and least risky to get into, I think that it’s also the most limiting space.

Anyway, I first saw the benefits of living an asset focused lifestyle way back in 2010 when I bought my first house.

I bought it for $222,500, when I told myself my max price was $220,000. But my agent convinced me it would have better resale value later, and seriously, what does $2,500 matter when you’re in the real estate space anyway?

Because I paid more attention to my long-term networth, and ignored cash flow by investing more than I had originally budgeted, I had an opportunity that many others didn’t. I even bought the house the same week I was graduating college and managed to rent out it to friends.

They covered the mortgage plus utilities, water, and wifi. The average cost of repairs was just over $110/mo, and that was about only cost I had to cover while I was living there.

And then I noticed the house was appreciated often times $5,000 per month — equivalent to a $60,000 salary.

That’s when I realized it’s okay to put aside your monthly cash flow goals if you have a serious strategy of acquiring assets such as real estate, cars, and online assets.

This blog I’ll be focusing on automotive, as those were the first assets that really got me into entrepreneurship way back in undergraduate at University of Denver.

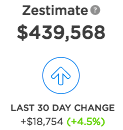

But wait, just to get you guys as excited as I am for Part 2 (real estate) of this 3 part blog serious, here’s a photo of the house today, 7 years later, and how much it appreciated in the last 30 days ($18,754 according to Zillow).

As you can see, assets should be your primary focus as your plan B as you set out to pursue your dream full-time, without a salaried job.

Automotive

The easiest and least expensive assets to get into.

BUY LOW, SELL HIGH

I was a student at DU and had just gone through a bad break-up, being heartbroken I figured I’d buy a motorcycle. Heck, I could ride a bicycle and drive a stick, what’s the worst that could happen?

Or, what’s the best that could happen you ask? Selling it for a $300 profit a few months later.

As a college student, making $300 all on my own was thrilling. I went home for winter break, got chewed out for riding motorcycles from my loving family, and went back to school looking for the next good deal. Next, I got into a few cars and trucks, too.

I bought low, and sold high and made money solely off negotiating. How did I make money without putting $$$ into the motorcycles, cars, and trucks?

I bought from someone who was moving out of state, or going through a divorce who needed the cash right away. They cared about that more than the purchase price.

Maybe I’d give it a car wash and practice tinting the windows (see my tint the windows on my new BMW here), but most importantly, when I put it up for sale, I priced it high and I stayed patient and firm when people tried to negotiate with me.

One of my favorite purchases was a black VW GTI (2 door turbo) that I bought for $5,500, which was higher than most the cars I’d purchase. It was super clean and sold just 30 days later for $7,200. After my cost, I remember making about $1,4xx.xx, and was pumped about no only the profit, but how short I held the car! If I would have ever become a Dealer, I probably could have been successful. But, cars are too much work. About one out of ten cars would blow up or have a serious maintenance problem that would result in me losing money on it.

Today, when I buy a car from a private party or dealer, I don’t even check the book value, I see what they’re selling for on craigslist, Cars, and autotrader.com.

There’s a point where you need to stop doing research and start making decisions. That’s what will get you to where you’re trying to go.

But, don’t expect to make very much money if you want to own your car longer than a year, autos are depreciating assets. The only way to make money by holding it for longer than a year is renting it out!

PS Your insurance policy probably doesn’t allow the following.

BUY LOW, RENT HIGH, THEN SELL.

All the shenanigans I just told you about was back before I graduated in 2010, and friends would always ask me if they could borrow my truck when I had one. They even said they’d pay me.

But sadly, there wasn’t a shared marketplace that was widely adopted like there is now: Turo.

Today, I think Turo is a great way to ‘monetize’ a few thousand miles on cars you might be buying and selling. I’m still not completely convinced that the wear and tear + depreciation of your car is worth your time with Turo, but many people here in Denver are making $10,000+/month of their fleet of Turo cars.

You see whether you’re an Uber driver or Turo owner, you need to budget for the depreciation and additional maintenance and repairs you’ll have to spend on your car.

That was one of the big reasons I got out of autos — smaller numbers, depreciating assets, lots of maintenance, and lots of restricting laws.

Before I start bashing the auto industry, let me give you some fun case examples with my experience with Turo.

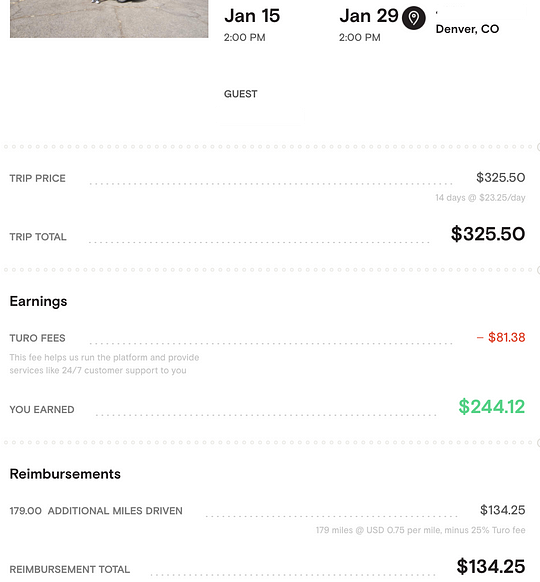

Here’s a 2 week reservation that paid for 10% of my $2,400 vehicle I invested in solely to rent on Turo, a 2007 Suzuki Forenza.

You can see I made 10% of the cost of the car in 2 weeks.

And then the additional $134.25 is because guest actually drove additional miles that resulted in an additional 50% profit.

Costs that aren’t pictures are depreciation, the average cost or maintenance and repair per mile. Those are hard to track until after-the-fact. So keep that in mind.

What ended up happening with this Suzuki was that it threw a check engine light while a renter was driving it, which turned out to be a blown head gasket.

That repair would have cost almost the same amount of the car. So I didn’t make money on this one. Plus its small beans, but I wanted to test it with a few thousand before several thousand.

However, read about what happened to my daily driver, my Lexus GS350 when it was totalled on its second trip here.

I learned that you can make okay money on Turo, but all the top Turo Fleet Owners in Denver are making a ton of money off of the fees. I asked Chris Schmidt, Turo owner with 14 cars, what his best reservation was, and he said, “What from fees? Probably $1,000 with fee; but without fees it’s not like I get 2 month rentals. I think my longest rental was 10 days most of mine stay between 2–4 days.”

Whether you have the tolerance to rent your car out, or simply try renting someone else’s out to start with, get a credit and sign up for Turo here.

As we wrap this blog post out, let’s zoom out and leave the auto industry for a moment.

In real estate (read Part 2 — COMING SOON), your house and land generally get more valuable, but of course, requires a much larger down payment. And it’s much harder to buy with cash, which can often times be your negotiating power in the private party auto industry. If you ever want to pull a salary from your ‘side hustles’ it’s easy in real estate because you’re playing with hundreds of thousands of dollars instead of several thousands of dollars.

In the online world, it’s the wild wild west, but I’ve recently found a way to make hundreds of dollars off of small websites (more on that in Part 3 — COMING SOON). And I don’t have to deal with tenants and contractors, which were my biggest complaints in real estate.

Today, I’m in the online marketing and online asset space. I had left the auto industry to get into Real Estate back in 2011, which I then left after 3 years to get into what I like to think of as ‘online real estate.’ I’ll write part 2 and part 3 about the pros and cons of each of those.

In the meantime, check out my video on how to buy a used car, and yes, this was me buying the lexus that I mentioned above was totalled.

Originally posted at www.handshakin.com.