As an Assistant Director in Concierge Planning, you will collaborate with legal and financial professionals to create estate plans for high-net-worth clients, analyzing documents and developing tailored strategies while managing workflows effectively.

Summary

In this client-facing role, you will be part of a dynamic and growing team of professionals that designs comprehensive estate and business plans for clients with complex planning needs. You will provide case consultation and strategy, and review and analyze legal documents and provide written overviews. You will use your planning experience to develop and deliver customized plans for high-net-worth clients and business owners. Existing estate and business planning acumen, strong communication and influence skills, and excellent writing and organizational skills are required.

Primary Duties and Responsibilities

Qualifications

Compensation Range:

Pay Range - Start:

$114,450.00

Pay Range - End:

$212,550.00

Geographic Specific Pay Structure:

Structure 110:

$125,930.00 USD - $233,870.00 USD

Structure 115:

$131,600.00 USD - $244,400.00 USD

We believe in fairness and transparency. It's why we share the salary range for most of our roles. However, final salaries are based on a number of factors, including the skills and experience of the candidate; the current market; location of the candidate; and other factors uncovered in the hiring process. The standard pay structure is listed but if you're living in California, New York City or other eligible location, geographic specific pay structures, compensation and benefits could be applicable, click here to learn more.

Grow your career with a best-in-class company that puts our clients' interests at the center of all we do. Get started now!

Northwestern Mutual is an equal opportunity employer who welcomes and encourages diversity in the workforce. We are committed to creating and maintaining an environment in which each employee can contribute creative ideas, seek challenges, assume leadership and continue to focus on meeting and exceeding business and personal objectives.

FIND YOUR FUTURE

We're excited about the potential people bring to Northwestern Mutual. You can grow your career here while enjoying first-class perks, benefits, and our commitment to a culture of belonging.

In this client-facing role, you will be part of a dynamic and growing team of professionals that designs comprehensive estate and business plans for clients with complex planning needs. You will provide case consultation and strategy, and review and analyze legal documents and provide written overviews. You will use your planning experience to develop and deliver customized plans for high-net-worth clients and business owners. Existing estate and business planning acumen, strong communication and influence skills, and excellent writing and organizational skills are required.

Primary Duties and Responsibilities

- Active collaboration with other professionals on the team (attorneys, CFPs, CPAs) and top wealth management advisors to create comprehensive wealth plans for high-net-worth clients with an emphasis on estate planning, wealth transfer, and business succession strategies.

- Design strategies based on the clients' goals and financial situation to inform and drive client decision making.

- Lead presentation of wealth plans to advisors and clients.

- Collaborate with clients' outside legal and tax advisors.

- Responsible for managing workflow in alignment with service level agreements (i.e., delivery of requested analyses and services timely and accurately).

Qualifications

- JD from an accredited program. Additional advanced degree or designations preferred, such as CFP, CPA, or LL.M.

- Minimum of 5 years of estate and business planning experience, preferably in a consulting role with clients and/or financial advisors.

- Existing knowledge and willingness to deepen in planning areas including tax optimization, estate and business succession, and wealth transfer strategies.

- Experience working directly with high-net-worth clients in estate and business planning, as well as tax planning.

- FINRA Series 6 or 7 as well as state insurance license within the first 6 months of hire.

- Strong analytical skills. Requires excellent follow-up, self-management of daily duties, and ability to collaborate with other professionals.

- Outstanding written and verbal communication skills with the ability to translate complex concepts into client-friendly, understandable, and actionable advice.

- Proven ability to develop trusting relationships with financial advisors and be a team player.

- Experience with planning software (such as MoneyGuidePro, eMoney Advisor, or WealthTec) a plus.

Compensation Range:

Pay Range - Start:

$114,450.00

Pay Range - End:

$212,550.00

Geographic Specific Pay Structure:

Structure 110:

$125,930.00 USD - $233,870.00 USD

Structure 115:

$131,600.00 USD - $244,400.00 USD

We believe in fairness and transparency. It's why we share the salary range for most of our roles. However, final salaries are based on a number of factors, including the skills and experience of the candidate; the current market; location of the candidate; and other factors uncovered in the hiring process. The standard pay structure is listed but if you're living in California, New York City or other eligible location, geographic specific pay structures, compensation and benefits could be applicable, click here to learn more.

Grow your career with a best-in-class company that puts our clients' interests at the center of all we do. Get started now!

Northwestern Mutual is an equal opportunity employer who welcomes and encourages diversity in the workforce. We are committed to creating and maintaining an environment in which each employee can contribute creative ideas, seek challenges, assume leadership and continue to focus on meeting and exceeding business and personal objectives.

FIND YOUR FUTURE

We're excited about the potential people bring to Northwestern Mutual. You can grow your career here while enjoying first-class perks, benefits, and our commitment to a culture of belonging.

- Flexible work schedules

- Concierge service

- Comprehensive benefits

- Employee resource groups

Top Skills

Emoney Advisor

Moneyguidepro

Planning Software

Wealthtec

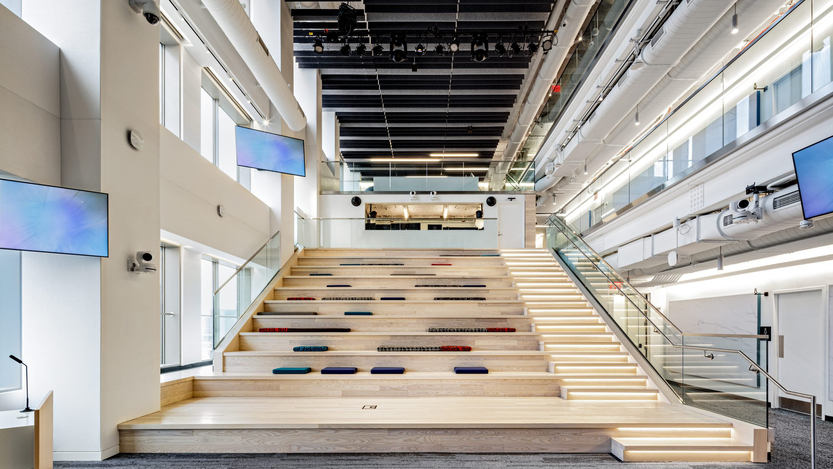

Northwestern Mutual New York, New York, USA Office

Northwestern Mutual NYC is located in Brookfield Place, convenient to the Fulton Street Hub, PATH Trains and NY Waterway Ferries.

Similar Jobs at Northwestern Mutual

Fintech • Insurance • Financial Services

The role involves consulting with financial advisors to enhance productivity and profitability through planning practices, analyzing financial goals, coaching on presentations, and leading training initiatives.

Top Skills:

Financial Planning Software

What you need to know about the NYC Tech Scene

As the undisputed financial capital of the world, New York City is an epicenter of startup funding activity. The city has a thriving fintech scene and is a major player in verticals ranging from AI to biotech, cybersecurity and digital media. It also has universities like NYU, Columbia and Cornell Tech attracting students and researchers from across the globe, providing the ecosystem with a constant influx of world-class talent. And its East Coast location and three international airports make it a perfect spot for European companies establishing a foothold in the United States.

Key Facts About NYC Tech

- Number of Tech Workers: 549,200; 6% of overall workforce (2024 CompTIA survey)

- Major Tech Employers: Capgemini, Bloomberg, IBM, Spotify

- Key Industries: Artificial intelligence, Fintech

- Funding Landscape: $25.5 billion in venture capital funding in 2024 (Pitchbook)

- Notable Investors: Greycroft, Thrive Capital, Union Square Ventures, FirstMark Capital, Tiger Global Management, Tribeca Venture Partners, Insight Partners, Two Sigma Ventures

- Research Centers and Universities: Columbia University, New York University, Fordham University, CUNY, AI Now Institute, Flatiron Institute, C.N. Yang Institute for Theoretical Physics, NASA Space Radiation Laboratory