In March 2020, as New York City’s shutdown began to take form, VTS Data Product Manager Julie Walsh dove into her team’s soon-to-be-released platform, a tool that offers real-time insights into the commercial real estate leasing landscape.

That’s when she noticed the entire country had stopped looking for office spaces.

“Demand had completely come to a standstill,” Walsh said, a trend that would continue for about four months.

Instead of waiting this period out, as many businesses throughout 2020 were forced to do, VTS continued its roadmap to release two new products, hire 100 people in six months and begin an acquisition that would transform VTS’s platform into an end-to-end solution.

That’s in addition to temporarily pivoting its core product, a leasing and tenant management platform used by more than 45,000 landlords, to a dashboard that provided COVID-19 insights and tenant impact, free of charge.

“We chose not to worry about spending a little money to help our customers and offer this product for free,” said General Manager of VTS Market Noah Borenstein. “We understood we had an opportunity to solve problems for our customers and push ourselves to places we wouldn’t normally go had we not been faced with the challenges of 2020.”

For more on VTS’s banner year and a look into its newest products, VTS Data, VTS Market, and VTS Rise, Built In NYC spoke with Borenstein, Walsh and VP of Business Operations Adnan Darr.

Full Coverage

- VTS Lease helps landlords manage deals, leases and tenants online

- VTS Data provides real-time market data and competitive insights

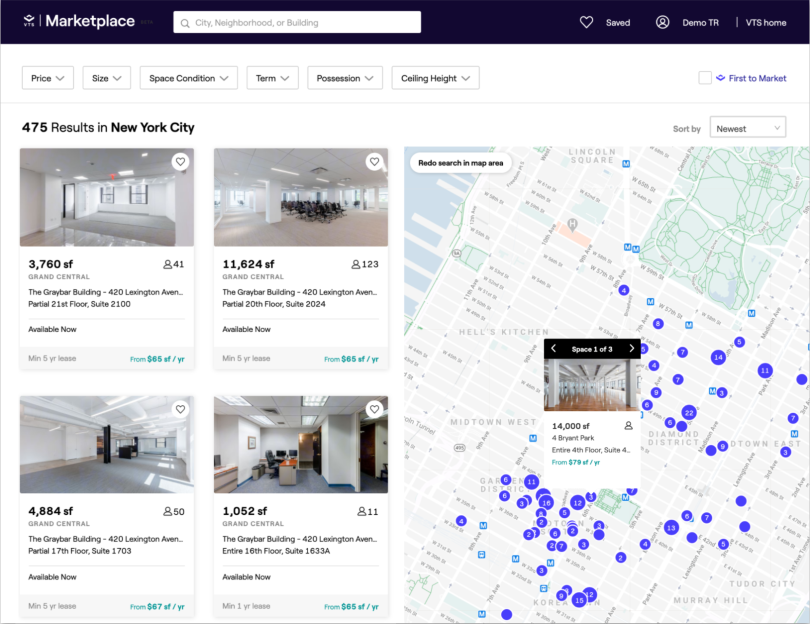

- VTS Market offers online marketing for spaces and virtual tours

- VTS Rise brings to one platform property operations and tenant experience

The average data point in commercial real estate leasing is one day old, according to VTS. That means investment teams often rely on anecdotal data and general market reports to inform their business decisions.

With VTS Data, a platform that went live in October 2020, VTS aims to provide the industry with real-time active tenant demand and future supply fluctuation projections based on its proprietary data collected through VTS Lease and VTS Market.

Walsh shared what the experience was like to launch VTS Data during the pandemic and how customers have responded since.

What risks or challenges arose during VTS Data’s rollout?

Julie Walsh, Data Product Manager: VTS Data was always part of VTS’s vision, but as the pandemic hit, we had to make a lot of decisions quickly. A lot changed in a very short period of time, like the way in which we operated our core product, launched our new products and hired people when it was unclear how the economy was going to be impacted.

We took a lot of risks there and continued to hire on teams to execute our vision, when maybe other companies wouldn’t have been hiring teams of people. We hired 30 people in the course of three months to scale our team.

How have customers responded?

Now that our clients have a trustable source of data, they said they’ve been able to make high-value investment decisions much faster. That’s really important, especially now, as things are changing so quickly in the market. Our goal is to make data-driven decision-making the norm for commercial real estate. That’s the direction that our industry is going in, and we’re making that possible.

Our goal is to make data-driven decision-making the norm for commercial real estate.”

What other wins have you noted since launch?

We strengthened our relationships with our clients because we were meeting with them every day to provide insights and anything else we could do to help them make investment decisions and their strategies. That was a huge win. Internally, we added a lot of expertise that we didn’t have before at VTS; for example, when we hired an entire research team that was focused on commercial real estate, and a new data science team that works with our customers and other data science teams.

Like VTS Data, VTS Market, a marketing solution to help attract tenants, was also on the company’s roadmap well in advance of 2020. However, as COVID-19 spread, VTS issued significant changes to the first-party commercial real estate listing platform’s roadmap.

“We had planned to roll out VTS Market to two to three markets through a soft launch first,” Borenstein said. “Instead, we moved up the timeline and launched on a much bigger scale.”

How did your team respond and change VTS Market’s rollout to better serve customers?

Noah Borenstein, General Manager of VTS Market: We had a lot of pieces in place for VTS Market already, then when COVID-19 hit, we wanted to be responsive because there were so many uncertainties surrounding the market. When no one could or wanted to visit available spaces in person, we focused on providing virtual tours, floor plans and up-to-date data from landlords to give accurate and real representation of what the spaces looked like.

We built a nationwide network of people and basic infrastructure in three months so that we could film spaces almost anywhere in North America. There were definitely some anxious moments during it, but we rallied and delivered on what our customers asked for.

How has VTS Market been received?

We brought on some of the biggest landlords in the industry. In New York, we brought on eight of the top 10 landlords within the first few months.

By the middle of 2020, VTS had expanded its leasing management solution to also offer online marketing for properties and asset and investment strategy, effectively covering the before, during and future steps of the landlord experience.

One gap remained though.

“Once that lease is signed, before a tenant needs another lease or is up for renewal, there’s this black hole of knowledge transfer between landlords and tenants,” said Adnan Darr, VP of business operations.

Introducing: VTS’s acquisition of Rise Buildings in May 2021.

What did VTS gain following the Rise acquisition?

Adnan Darr, VP of Business Operations: VTS Rise offers key visibility and analytics to what’s happening inside of the buildings and a fully operational platform that integrates into access control companies. We offer visitor management, package management, bookings, and financial integrations into property management systems. Between our hardware and software, we’re providing analytics and real operational solutions that can bring down costs for running a building while also reducing waste.

What wins have you tallied from the acquisition?

The collaboration of teams coming together for this has been a huge win, but for the clients, we’re now able to go back to them and say we have filled in for you everything that was missing before. Between VTS Lease, VTS Market, VTS Data and VTS Rise, we can cover all bases and not just one slice of the pie. Plus, now everything is available to them on one platform. They can log into one site and do pretty much everything they need to do for the operations of their building from one place, and that information is still being pushed out to the other sources so that visibility remains for people who use those other systems.

What’s the connective thread between VTS Market, VTS Data and VTS Rise?

Borenstein: It’s the end-to-end experience that our customers have from bringing a piece of a space to the market, marketing that space, leasing that space, and understanding what’s happening while the tenant is there. Then, as we go through it, we are able to deliver all the data from each of those touch points and help our clients strategize on how to bring the next piece of space to the market.

Walsh: I’m most excited that we’re going to be able to aggregate trends across tenant behaviors, returns on investments from building improvements, amenities, leasing, industry and markets. The more data we can capture, the more value we’re adding to our clients.