Wingocard, a new mobile banking app designed just for teens, has officially launched following a $1.7 million seed announced Wednesday. This, plus a previously raised $1.3 million round, brings the NYC-based startup’s total seed funding to $3 million.

This most recent round was led by Panache Ventures, with participation from Diagram Ventures and various angel investors. The money will be used to accelerate Wingocard’s growth and build new “gamified financial literacy tools” that help teens with their personal finances.

“We all have this little anxiety for teens to be financially smart, and to one day, be successful,” co-founder and CEO Sebastien Brault told Built In. “Our mission is really to empower the new generation of teens to become smarter with money by providing them a great banking experience and tools for them to learn.”

Brault is a father to two teens himself, and says he was inspired to create Wingocard after he and a friend talked about how difficult it was to manage their kids’ finances. If you give them cash, there is no traceability, and they just wind up using a parent’s credit card anyway for online purchases. And you don’t want to give them free rein over a normal bank account and debit card because they don’t understand the intricacies of money management yet.

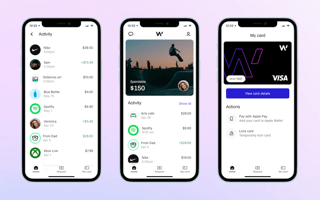

So, Brault and his team designed Wingocard to provide all the financial tools he would want his own children to have. These include typical offerings like a debit card and no overdraft fees, as well as unique features like automated allowances, money management tools and a community to learn from.

The whole app is peppered with various gamification elements, designed to make it fun and easy for users to learn about the merits of saving and budgeting. Brault says he wanted Wingocard to be a way to teach teenagers about finances without making it feel like they’re learning. He wanted it to feel like a game, not a school assignment, cutting through popular distractions like social media and video games.

“If we want to help our teens learn about finance, we need to keep them engaged. And the way to do that is simply through gamification,” Brault said, adding that this can be as simple as giving out points each time a teen logs into the app to help form the habit. “We have to think about creative ways that we can essentially help teens be engaged and learn.”

Of course, this is an ongoing process. Brault says he and his team are years away from figuring out exactly how to keep kids interested in money management. And this is an area other startups are trying to crack as well — for both teens and adults. Over the last several months, Built In has featured a handful of companies (like Charlie and Bella) that are working to make banking fun for everyone, disrupting the often confusing and predatory system that legacy banks have been benefiting from for decades.

When Brault began looking at the space more closely in 2019, he saw that it wasn’t getting much action — incumbent banks “didn’t really care” about money management for teens. There has since been an explosion of these kinds of challenger banks, and investors have begun to take notice. Just last month, teen banking app Step received $100 million from General Catalyst and a bevy of celebrity investors including Will Smith and Jared Leto. Around the same time, Current, another mobile banking app that began as a debit card for teens, tripled its valuation to more than $2 billion after a $220 million raise led by Andreessen Horowitz.

What sets Wingocard apart, says Brault, is its ability to “talk with teens directly” instead of taking a parent-to-child approach. Teens ages 13 and older create their own account and can invite their parents to link up with them. From there, parents can grant their teens an allowance and send direct deposits. Teens can also track their own spending and use either a physical or digital debit card to make purchases. Soon, the app will also include features like chore charts, financial quizzes with cash prizes, and more tools to better track financial goals.

“We’ve all had our so-so experiences with banks and financial institutions, and a lot of that has been caused by the fact that we didn’t have correct information when we were younger. And they benefited from our bad behavior,” Brault said. “What we want to do is help this new generation become smarter with their money, and be smarter than we were.”

Wingocard appears to be in hot demand already, with more than 75,000 teens on its waiting list now. Now that it has launched, the company will begin to grant access from the waitlist in cohort groups.