Meetup acquired by WeWork for a reported $200 million

WeWork went on a veritable shopping spree this week, including its purchase of Meetup, an NYC-based social networking platform aimed at bringing together individuals with similar interests. The acquisition — which was valued at a reported $200 million — seemed to be a natural fit for both companies, as many Meetup members already make use of WeWork’s coworking space across the globe. [Built In NYC]

Group Nine Media seals $40 million deal with focus on video content

Discovery Communications, Axel Springer, and Lerer Hippeau Ventures are among those channeling $40 million into Group Nine Media’s push for increased video content. Group Nine Media acts as an umbrella company for New York-based web companies NowThis, Thrillist, The Dodo, and Seeker. [Built In NYC]

Women-only coworking space The Wing secures $32 million in Series B funding

The Wing — the women-only coworking space with several locations across New York City — brought its funding total to more than $42 million this week, after closing a $32 million Series B round. The funding was led by WeWork, another major player in the coworking space market. [Built In NYC]

Nooklyn reveals plans for workforce expansion and a new Manhattan office

Apartment hunting and roommate-finding service Nooklyn recently announced plans to expand from their Brooklyn digs to WeWork’s Union Square location before the end of 2017. In 2018, the company plans to scale its 250-person workforce to at least 330, in addition to opening a flagship Manhattan office. [Press Release]

SoulCycle co-founder joins WeWork as Chief Brand Officer

Julie Rice, co-founder of legendary fitness boutique SoulCycle, is joining the WeWork empire. After stepping down from her role with SoulCycle in 2016, Rice has recently signed on as WeWork’s chief brand officer. Reportedly, Rice’s new role will focus on developing programs and services for members of WeWork’s coworking spaces around the world. [The Real Deal]

Remedy Health Media — the “anti-WebMD” — acquired by Topspin partners

Private New York-based equity firm Topspin Partners recently acquired Remedy Health Media for an undisclosed amount. Remedy, which reportedly reaches more than 35 million unique viewers each month, focuses on providing quality medical informations and inspirational stories to patients and caregivers. As the self-proclaimed “anti-WebMD,” the media company and its properties emphasize treating those with pre-existing conditions, as opposed to offering diagnoses. [Press Release]

Cryptocurrency software developer Libra raises $7.8 million in Series A funding

Libra, the company behind a large-scale cryptocurrency tax solution, recently raised $7.8 million in Series A funding. This latest round brings Libra’s funding total to more than $8.3 million. By coincidence, the same day that Libra announced its Series A closing, cryptocurrency Bitcoin reached an astonishing value of $10,000 per unit. [Built In NYC]

Emu Technology completes Series A-2 funding and raises $5 million in the process

It was a big week for big data computing company Emu Technology, who walked away from its Series A-2 funding round with $5 million in backing from Samsung Ventures Investment Corporation in addition to previous supporters. The company plans on using the funds to grow the availability of their computer technology. [Press Release]

Flatiron School will host “Code Drive” to support refugee scholarship fund

Just in time for the season of giving, Manhattan-based coding bootcamp Flatiron School is sponsoring a Code Drive. Each time someone completes a coding lesson on Learn.co, Flatiron School will donate $1 to a scholarship fund benefiting refugees from around the world. The drive is open to all participants. [Press Release]

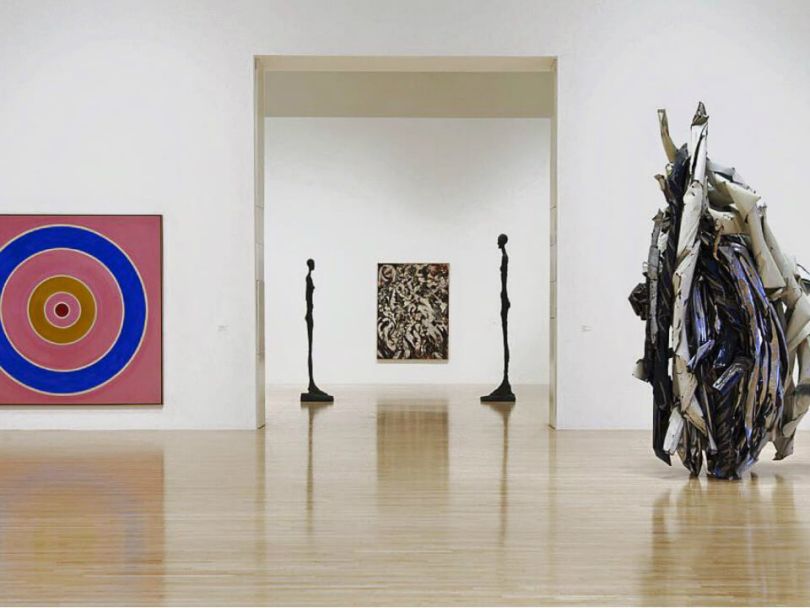

FinTech startup Arthena hopes data science can predict the value of art

Brother and sister team Madelaine and Michael D’Angelo recently launched Arthena, an NYC-based startup they say uses data science to predict the long-term appreciation of artwork. The creative company, who has already partnered with big names like Charles Schwab, aims to make art a more common feature of any investment portfolio. [Bloomberg]