Get the job you really want.

Maximum of 25 job preferences reached.

Top Quantitative Researcher Jobs in NYC, NY

Reposted 21 Hours AgoSaved

Information Technology • Software • Financial Services • Big Data Analytics

Quantitative Researchers at GQS leverage advanced statistical techniques and machine learning for investment strategies, portfolio optimization, and innovative research.

Top Skills:

C++Python

Reposted 21 Hours AgoSaved

Information Technology • Software • Financial Services • Big Data Analytics

As a Quantitative Researcher at Citadel, you will use advanced statistical and machine learning techniques for investment modeling and portfolio optimization.

Top Skills:

C++Machine LearningPythonStatistical Modeling

Information Technology • Software • Financial Services • Big Data Analytics

Quantitative Researchers at Citadel leverage statistical modeling and coding skills to analyze financial data and develop optimization algorithms. They drive portfolio construction and focus on solving real-world financial problems.

Top Skills:

C++Python

Information Technology • Software • Financial Services • Big Data Analytics

Global Quantitative Researchers at Citadel leverage advanced statistical and quantitative techniques to drive investment strategies and optimize portfolios.

Top Skills:

C++Python

Information Technology • Software • Financial Services

The role involves developing and testing quant trading strategies through mathematical modeling, statistical analysis, and implementing these into trading systems.

Top Skills:

C++PythonR

Information Technology • Software • Financial Services

The internship involves developing automated trading strategies, performing statistical analyses, and implementing trading models in a live environment.

Top Skills:

C++PythonR

Information Technology • Software • Financial Services • Big Data Analytics

As a Quantitative Researcher Intern, you will develop trading models, conduct statistical analysis, and collaborate in a fast-paced research environment.

Top Skills:

C++PythonR

Information Technology • Software • Financial Services • Big Data Analytics

Quantitative Researchers develop and refine trading models, conduct statistical analysis, and innovate using complex data sources in financial markets.

Top Skills:

C++PythonR

Artificial Intelligence • Fintech • Hardware • Other • Automation

Quantitative Researchers at HRT develop mid-frequency trading strategies using statistical methods and large datasets, focusing on coding and strategy components.

Top Skills:

C++Python

Reposted 12 Days AgoSaved

Information Technology • Software • Financial Services

Conduct research, statistical analyses, and develop trading strategies using sophisticated statistical techniques and large data sets.

Top Skills:

C++MatlabPythonR

Information Technology • Software • Financial Services • Big Data Analytics

As a Quantitative Researcher, you will utilize AI/ML methods and vast datasets to build advanced models for investment strategies and collaborate with investment teams for insights and hypothesis validation.

Top Skills:

C++JuliaPythonR

Reposted 22 Days AgoSaved

Fintech • Financial Services

The candidate designs, develops, and manages systematic market-making algorithms for electronic trading, conducting quantitative research and back-testing strategies to optimize performance and manage trading risks.

Top Skills:

C++DeephavenFixJavaKdbPython

New

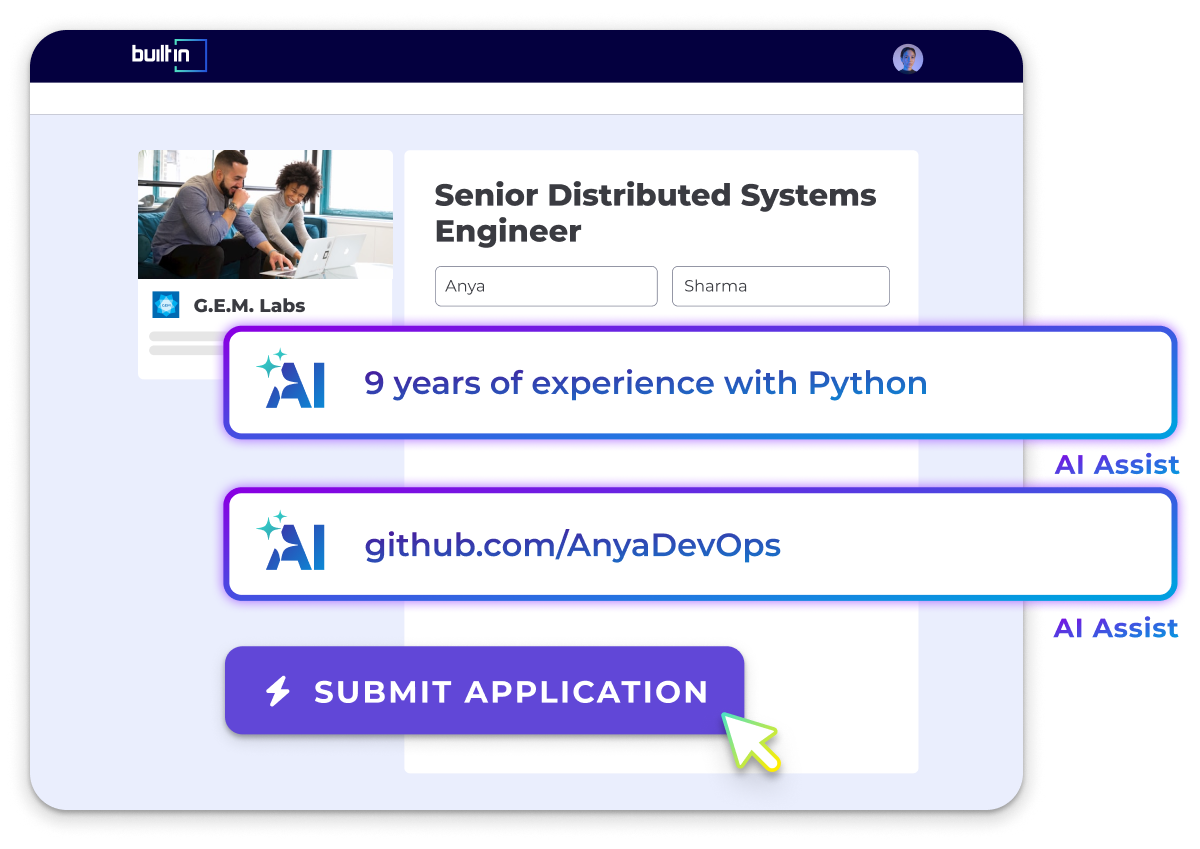

Cut your apply time in half.

Use ourAI Assistantto automatically fill your job applications.

Use For Free

Fintech

As a Senior Quantitative Researcher, you will analyze large data sets, build statistical models, implement trading strategies, and develop quantitative research tools.

Top Skills:

C++Python

Machine Learning • Software • Financial Services

The Quantitative Researcher will develop innovative quantitative strategies using statistical methods and machine learning algorithms to analyze market data and identify trading opportunities.

Top Skills:

C++Python

Financial Services

Conduct applied research to find systematic anomalies in futures markets, develop strategies, and present trading ideas based on high frequency data analysis.

Top Skills:

AWSC++LinuxPython

Financial Services

Conduct quantitative research focusing on predictive models, data analysis, alpha discovery, and trading strategy generation as part of a collaborative research team.

Top Skills:

PythonSQL

Financial Services

Develop systematic trading models, conduct alpha idea generation, backtesting, and enhance trading environments while utilizing advanced quantitative methods.

Top Skills:

NumpyPandasPythonScikit-Learn

Financial Services

The role focuses on quantitative portfolio optimization and risk control, involving analysis of transaction costs and monitoring portfolio performance.

Top Skills:

Data EngineeringPortfolio Optimization TechniquesQuantitative TechniquesRisk Modeling Tools

Fintech • Payments • Financial Services

As a Quantitative Researcher, you will analyze data, develop alpha signals, collaborate on performance analysis, and create pricing models while assessing risk.

Top Skills:

C++JavaMatlabPythonRRuby

Financial Services

The role involves conducting quantitative research in corporate bonds and credit derivatives, implementing models, and improving investment processes.

Top Skills:

Python

Fintech

The intern will research trading algorithms, enhance existing strategies, analyze market data, create analytical tools, and contribute to supportive libraries.

Top Skills:

Python

Fintech

As a Quantitative Researcher, you will enhance trading strategies through alpha research, model development, collaboration, and workflow optimization in a high-frequency trading environment.

Top Skills:

CC++JavaPython

Software

The Quantitative Researcher will develop systematic trading strategies, analyze data, enhance research tools, and work collaboratively with the Portfolio Manager.

Top Skills:

LinuxPythonSQL

Financial Services

Conduct research to find systematic anomalies in equity markets, develop strategies, evaluate datasets, and manage portfolio trading.

Top Skills:

PythonR

Financial Services

Conduct independent quantitative finance research focusing on statistical models, manage data collection, analysis, and performance monitoring.

Top Skills:

C#C++JavaMatlabPerlPythonR

Top NYC Companies Hiring Quantitative Researchers

See AllPopular Job Searches

All Data & Analytics Jobs in NYC

Analysis Reporting Jobs in NYC

Analytics Jobs in NYC

Business Intelligence Jobs in NYC

Data Engineer Jobs in NYC

Data Science Jobs in NYC

Machine Learning Jobs in NYC

Data Management Jobs in NYC

Analytics Engineer Jobs in NYC

Analytics Manager Jobs in NYC

Business Analyst Jobs in NYC

Compliance Analyst Jobs in NYC

Data Analyst Jobs in NYC

Data Architect Jobs in NYC

Director of Analytics Jobs in NYC

Operations Analyst Jobs in NYC

Principal Data Scientist Jobs in NYC

Quantitative Researcher Jobs in NYC

Research Jobs in NYC

Senior Business Analyst Jobs in NYC

Senior Data Analyst Jobs in NYC

Systems Analyst Jobs in NYC

All Filters

Total selected ()

No Results

No Results

_1.png)